Small business owners face various challenges, including qualifying for SBA loans and filing their taxes. With tax season around the corner, there is additional stress and work. The good news is, you can outsource a third-party business tax accountant to help you file your taxes.

Hiring an income tax accountant can take the heavyweight off your shoulders, as a certified CPA knows how to organize taxes for small businesses. Regardless, we would recommend staying on top of this process and ensuring your accountant has all the documents needed to file your business taxes in a timely and accurate manner.

If you’re wondering which documents you’ll need to provide to your accountant, you’ve come to the right place. In this blog, we’ll share what to bring to an accountant for tax preparation.

1. Personal Information

You’ll need to provide your full name, current address, social security number, legal business name,and your employer identification number.

2. Previous Year’s Tax Return

Sharing last year’s tax returns with your accountant will outline how your business operates and which income tax deductions your business qualifies for.

3. Financial Statements

Your financial statements, including your cash flow statement, balance sheet, and income statement, outline how profitable your business is. These reports provide you, your accountant, and the IRS a formal record of all your business’ financial activities, ensuring your taxes are accurate.

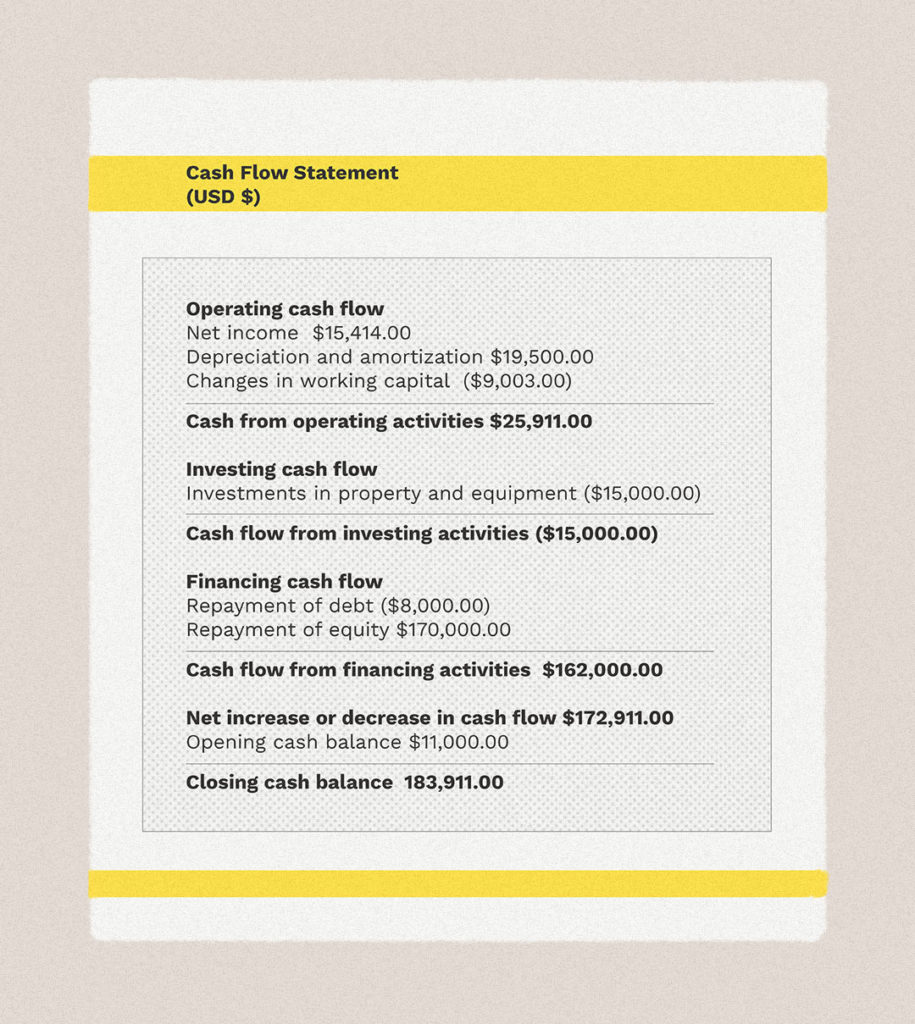

Cash Flow Statement

Your cash flow statement outlines how your cash inflows and outflows affect your small business’s liquidity. The cash flow statement is divided into three sections: operations, investing, and financing. Each section from your cash flow statement can add or subtract to your overall business cash flow.

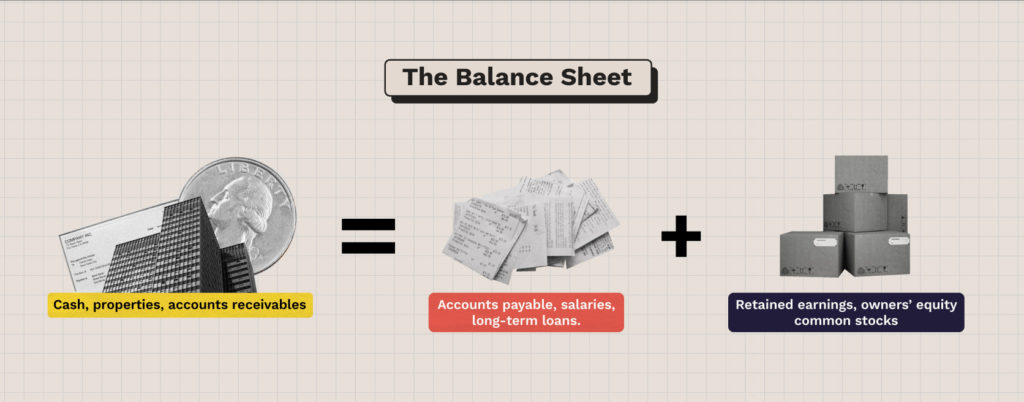

Balance Sheet

The balance sheet is based on a formula stating that your business assets should equal the sum of your liabilities and shareholders’ equity. This financial report outlines the capital structure of your business and which percentage of your assets you owe and own.

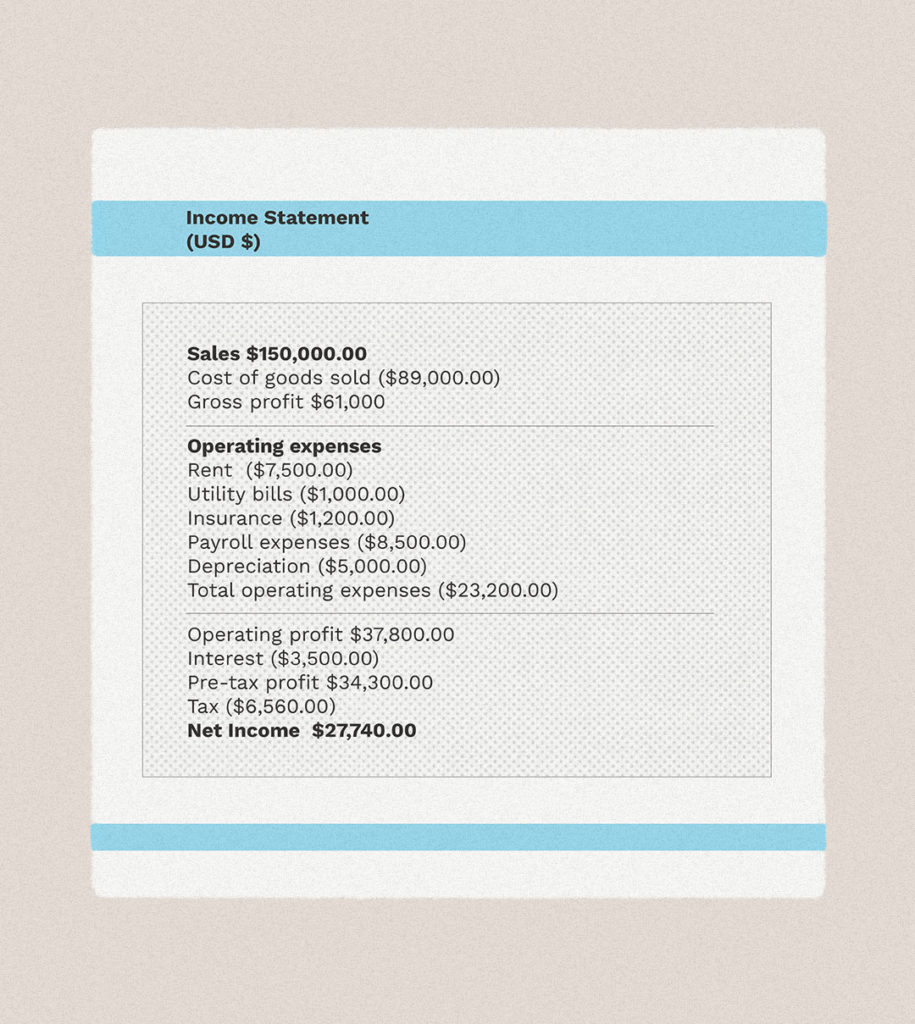

Income Statement

Your business income statement is one of the most important financial statements. It shows how profitable your business is after expenses, losses, and taxes.

4. Asset Information

Your business accountant should get the latest updates about the items of value you’ve bought, sold, or depreciated during the year. Provide all proper documentation regarding your assets’ transactions, including receipts, sale letters, loan agreements, payments, etc.

For example, your business assets include your office/work equipment, properties, furniture, vehicles, real estate, intellectual property, among others.

5. Loan Information

Your business tax accountant will need all information regarding any small business loan you’ve qualified for, including proof of loan payments and accrued interests, to fill and calculate your taxable income accurately.

COVID-19 monetary funds such as the Paycheck Protection Program (PPP), the Economic Injury Disaster Loan (EIDL), and EIDL Advance, will not be included as part of your taxable income.

Keep in mind that the IRS will forgive these funds’ income tax as long as you use them to pay for qualifying expenses such as payroll, utility, and rent. Otherwise, your business will pay a taxable income on any percentage of your PPP, EIDL, or EIDL Advance that is not forgiven.

6. Income & Expenses Records

Your income tax accountant needs access to all the documents that support the income and expenses you stated on your business financial reports, including invoices, receipts, bank statements, payroll information, etc.

How Do Taxes Work for Small Businesses?

The Internal Revenue Service requires small businesses to fill specific tax forms according to their business organization form. Below are some of the most common types of businesses linked to the corresponding tax forms owners must file for each class.

Feel free to visit the IRS website for more information on the tax forms your business is required to file. Also, keep in mind that your deadline to file your taxes may change depending on your business type.

Be One Step Ahead This Upcoming Tax Season

Keeping your business financial statements and records in order will help you have a seamless process while filing your taxes. You’ll save yourself money given that your small business tax accountant won’t worry about making sense of a pile of documents.

In addition to making your income tax accountant’s life easier, you’ll have a clear vision of your profitability. Consequently, you’ll spot areas of opportunities in your processes to help reduce expenses and scale your business.

Keen to learn more about small business management and marketing? Subscribe to our blog to get our latest tips ‘n tricks straight to your inbox! And, if you’re searching for a digital marketing team ready to go out of their way to help propel your business, contact us here.

a.

Article by Francis Espinoza

Francis is a Social Media Coordinator here at Olly Olly. Born and currently based in Nicaragua, her professional background and passion are all things inbound marketing.

Like what you read? Send Francis a message here.